nebraska sales tax calculator by address

The average cumulative sales tax rate in Elkhorn Nebraska is 7. The Nebraska state sales and use tax rate is 55 055.

Your Guide To The United States Sales Tax Calculator Tax Relief Center

The Nebraska state sales and use tax rate is 55 055.

. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Note.

Demonstration of Filing State and Local Sales and Use Taxes Form 10 - Single Location Current Local Sales. Lincoln Sales Tax Rates for 2022. Nebraska state sales tax rate range 55-75 Base state sales tax rate 55 Local rate range 0-2 Total rate range 55-75 Due to varying local sales tax rates we strongly recommend.

Request a Business Tax Payment Plan. Make a Payment Only. Sales tax calculator and tax rate lookup tool Enter your US.

Sales and Use Tax. Elkhorn is located within Douglas County. Form 10 and Schedules for Amended Returns and Prior Tax Periods.

Nebraska Department of Revenue. For example lets say that you want to purchase a new car for 60000 you would. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

Address below and get the sales tax rate for your exact location. The average cumulative sales tax rate in Omaha Nebraska is 686. Omaha has parts of it located within Douglas County.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation. Nebraska Sales Tax Calculator You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The calculator will show you the total sales tax.

Determine Rates - Or - Use my current location Why cant I just use. The base state sales tax rate in Nebraska is 55. This includes the rates on the state county city and special levels.

Lincoln is located within Lancaster County Nebraska. The average cumulative sales tax rate in Lincoln Nebraska is 688. Look up 2022 sales tax rates for Ames Nebraska and surrounding areas.

This includes the rates on the state county city and special levels. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling. ArcGIS Web Application - Nebraska.

So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the. Sales Tax Rate s c l sr. This includes the rates on the state county city and special levels.

Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. This form is read only meaning you cannot print or file it.

Tax rates are provided by Avalara and updated monthly. With local taxes the total sales tax rate is between 5500 and 8000. The Taxpayer Assistance offices in North Platte Norfolk and Scottsbluff are.

Sales Tax Rate Finder. Find your Nebraska combined state.

Nebraska Sales Tax Comparison Calculator Us Tax Calculator

Does Your State Have An Estate Or Inheritance Tax

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Property Tax Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

Earn Up To 000 In Tax Credits Nebraska Microentrerprise Tax Credit

How To File And Pay Sales Tax In Nebraska Taxvalet

Nebraska Income Tax Calculator Smartasset

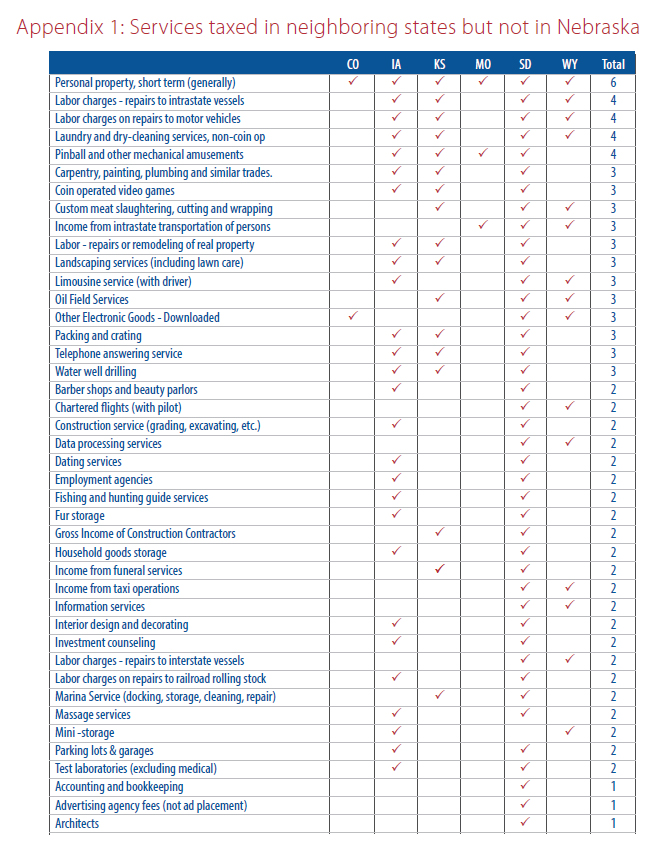

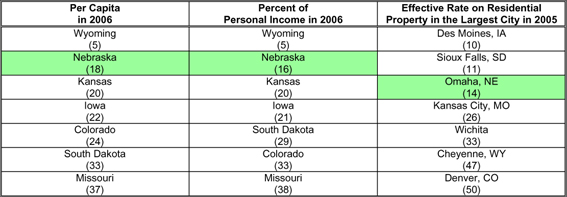

Taxes And Spending In Nebraska

11 9 Sales Tax Calculator Template

Tax Calculator Return Refund Estimator 2022 2023 H R Block

How To File And Pay Sales Tax In Nebraska Taxvalet

Taxes And Spending In Nebraska

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax